I have worked with different accounting and audit systems while handling financial reviews for small firms and mid size companies. Over time I noticed that many businesses in Kenya face the same challenge. They want accurate financial records but they also want tools that are simple to manage. Manual audits take too much time and often create errors. This is where software becomes useful.

In this article I will explain the common account audit software used in Kenya. I will also share what I have learned about selecting the right system for financial control and compliance.

What is account audit software

Account audit software is a digital tool that reviews financial records. It checks entries transactions balances and reports. The main goal is to confirm that financial statements are correct and follow regulations.

From my experience audit software helps in three major areas.

- Detecting errors in bookkeeping

- Tracking financial fraud risks

- Preparing audit ready reports

Instead of checking every ledger manually the system scans data quickly. This saves time and improves accuracy.

Why audit software is important in Kenya

Kenya has strict financial reporting rules especially for registered companies NGOs and financial institutions. I have seen businesses struggle during tax audits because their records were scattered.

Audit software helps Kenyan businesses in the following ways.

- Keeps records organized

- Supports KRA tax compliance

- Prepares financial statements faster

- Reduces manual paperwork

- Improves transparency for investors

For firms that handle grants public funds or large inventories audit tools are almost necessary.

Common account audit software used in Kenya

Below are the systems I see most often when working with Kenyan accountants and auditors.

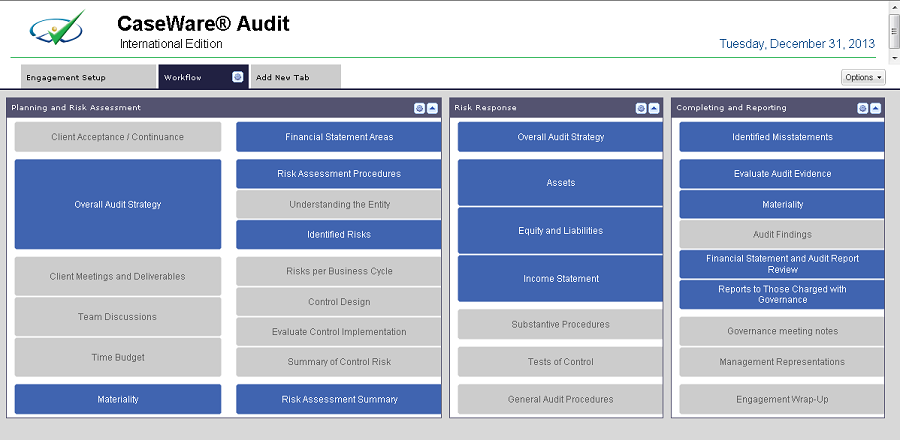

1. CaseWare Audit

4

CaseWare is widely used by professional audit firms. Many certified auditors prefer it because it follows global audit standards.

Key features I have used include.

- Automated working papers

- Risk assessment tools

- Financial statement generation

- Team collaboration options

It fits well for medium and large audit practices.

2. QuickBooks with audit tools

QuickBooks is popular in Kenya among SMEs. While it is mainly accounting software it has built in audit trails.

What I find useful.

- Tracks every transaction change

- User activity logs

- Bank reconciliation reports

- Expense and income verification

For small businesses QuickBooks works as both accounting and basic audit support software.

3. Sage Pastel

Sage Pastel has been used in East Africa for many years. I have audited companies that rely fully on Sage records.

Important audit related functions include.

- Detailed audit trails

- Ledger verification

- VAT reporting

- Custom financial statements

It suits retail manufacturing and service businesses.

4. SAP Audit Management

Large corporations and banks in Kenya often use SAP. It is powerful but requires training.

From my projects SAP helps with.

- Internal audit planning

- Compliance monitoring

- Risk scoring

- Enterprise financial tracking

It is ideal for organizations with complex operations.

5. IDEA Audit Software

IDEA focuses on data analysis. Auditors use it to test large financial datasets.

I use IDEA for.

- Detecting duplicate payments

- Sampling transactions

- Fraud pattern analysis

- Data imports from ERP systems

It is very useful during forensic audits.

Top features to look for in audit software

When I help firms choose systems I focus on practical functions not marketing claims.

Here are the most important features.

- Strong audit trail tracking

- Automated financial reports

- Multi user access control

- Data security and backups

- Tax compliance support

- Integration with accounting systems

If software lacks these basics it creates more work instead of saving time.

Role of Bookkeeping in Financial audits

Before any audit begins the quality of bookkeeping decides how smooth the audit will be. I always say that strong bookkeeping makes audits easier while poor records create delays.

Bookkeeping supports audits through the following.

- Daily transaction recording

- Proper ledger maintenance

- Expense classification

- Bank reconciliation

- Invoice tracking

When bookkeeping is clean audit software produces faster and more reliable financial insights.

Best account audit software for small businesses

Small firms in Kenya often ask me for affordable tools. They do not need enterprise systems.

The best options for them are.

- QuickBooks

- Sage Pastel Partner

- Zoho Books with audit logs

These systems are easier to learn and cost less to maintain.

Best audit software for large organizations

Bigger institutions need deeper financial control. I recommend.

- SAP Audit Management

- CaseWare Audit

- IDEA Data Analysis

These platforms handle large transaction volumes and complex reporting structures.

How I evaluate audit software in real projects

My evaluation process is practical and based on field work not theory.

I usually test software on these points.

- Import real financial data

- Run audit checks

- Review error detection

- Generate compliance reports

- Test user permissions

If the system performs well under real data pressure I consider it reliable.

Challenges businesses face when using audit software

Even the best tools come with difficulties. I have seen common problems such as.

- Lack of staff training

- Poor data entry practices

- High licensing costs

- Integration issues with old systems

Most of these issues are solved through proper onboarding and structured accounting processes.

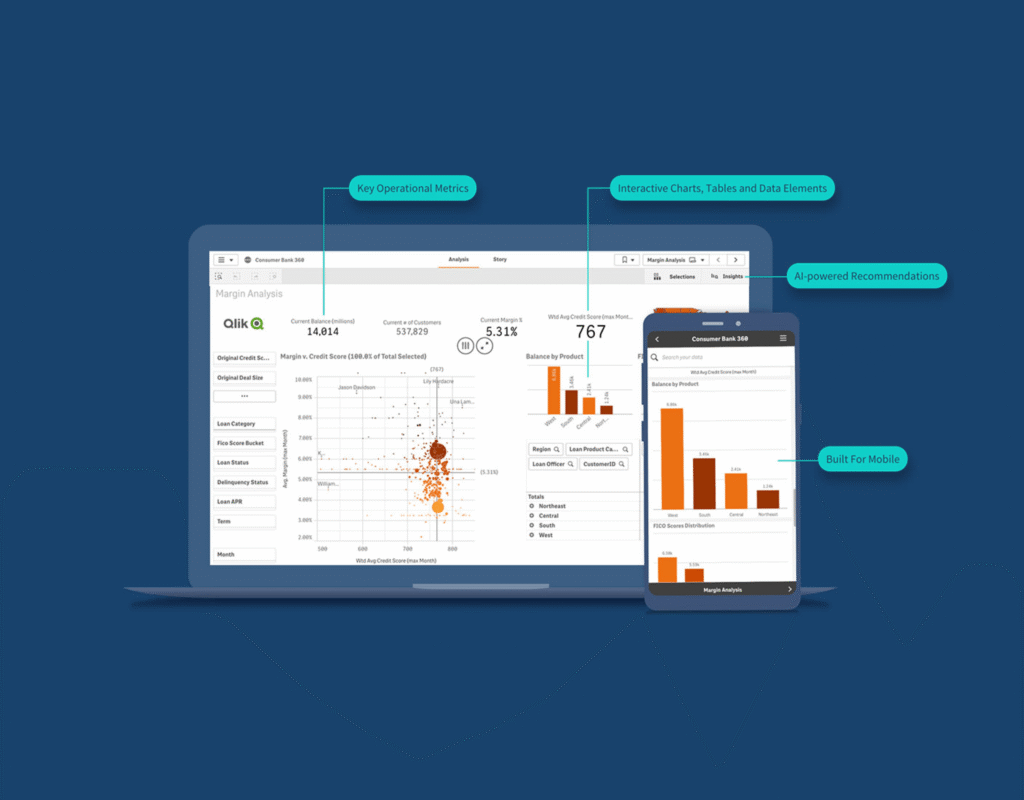

Future of financial audit software in Kenya

The audit field in Kenya is changing fast. More firms are moving to cloud accounting and remote audits.

Trends I am currently seeing include.

- Cloud based audit platforms

- Mobile access to financial reports

- AI assisted anomaly detection

- Real time tax compliance checks

As regulations grow stricter software adoption will continue rising.

Final thoughts

From my professional experience the use of common account audit software used in Kenya is no longer optional for serious businesses. Whether a company is small or large digital audit systems improve financial accuracy and compliance.

Frequently Asked Questions

1. What is account audit software

Account audit software is a digital system that reviews financial records transactions and reports. It helps auditors verify whether accounting and bookkeeping data is accurate complete and compliant with financial regulations.

2. Which is the most common account audit software used in Kenya

Some of the most common account audit software used in Kenya include CaseWare Audit Sage Pastel QuickBooks SAP Audit Management and IDEA Audit Software. These tools are widely used by audit firms companies and financial institutions.

3. How does bookkeeping support financial audits

Bookkeeping records daily transactions ledgers expenses and invoices. During an audit auditors rely on bookkeeping data to verify financial statements. Clean bookkeeping makes the audit process faster and more accurate.

4. What features should the best account audit software have

The best account audit software should include.

- Audit trail tracking

- Financial report generation

- Bookkeeping integration

- Data security controls

- Tax compliance tools

- Multi user access

These features ensure reliable financial reviews.

5. Is QuickBooks good for audit and bookkeeping

Yes. QuickBooks is suitable for small and medium businesses. It manages bookkeeping accounting and basic audit logs in one system. Auditors can track transaction history and financial changes easily.

6. Why do companies in Kenya need audit software

Companies in Kenya need audit software to maintain financial transparency comply with tax regulations and prepare accurate financial statements. It also reduces manual errors in accounting and bookkeeping.

7. What is the difference between accounting bookkeeping and audit software

Bookkeeping software records daily transactions. Accounting software manages financial reports and statements. Audit software reviews and verifies the financial data produced by accounting and bookkeeping systems.